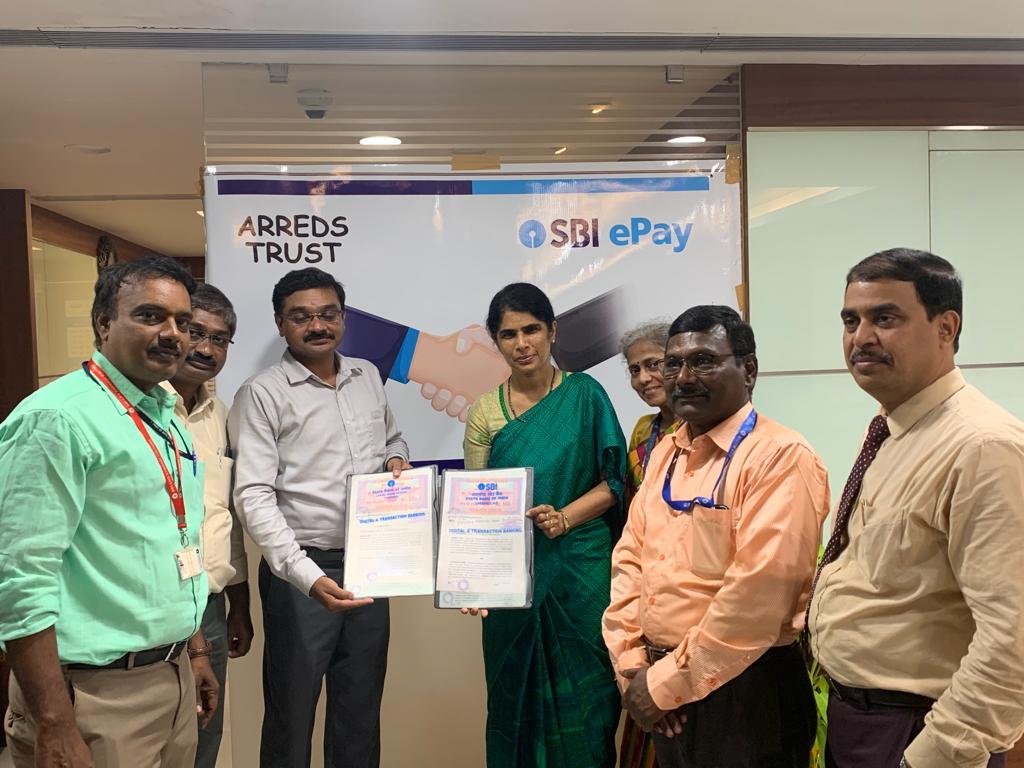

Arreds has enabled 1 Million people to Access Basic Banking Services in Rural and Semi- Urban Areas

To provide universal banking services for every unbanked household, based on the guiding principles of banking the unbanked, securing the unsecured, funding the unfunded and serving unserved and underserved areas under Financial Inclusion.

We, Business Correspondents are retail agents engaged by banks for providing banking services at locations other than a bank branch / ATM. BCs, thus, are an integral part of a business strategy for achieving greater financial inclusion.

OBJECTIVES

- To improve the understanding of mainstream financial services, and avoidance of non-standard services.

- To deepen the understanding of risks and benefits of financial services.

- To reduce the cost of information-search for the unbanked.

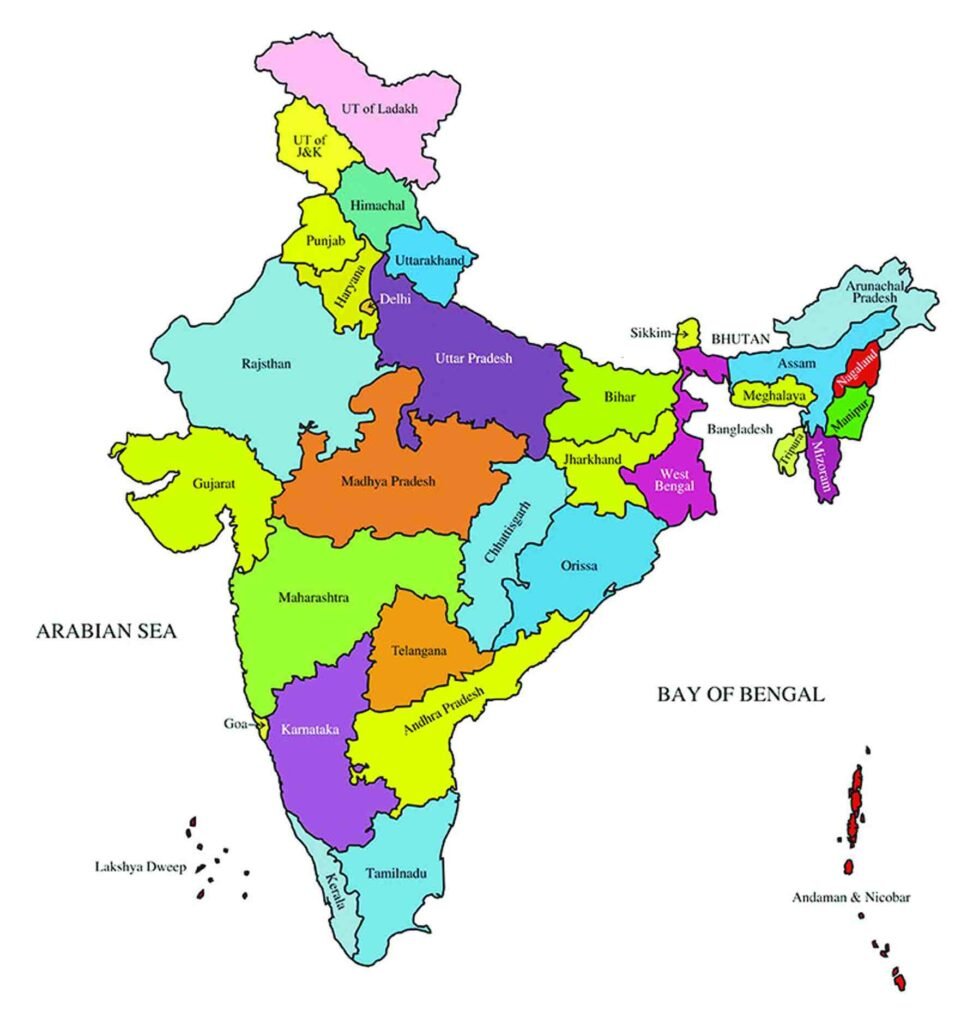

- To cater banking services in unbanked villages and rural centers of India.

- To cater banking services and financial access to Northeast India.

- To expand and deepen the Digital Payments’ Ecosystem.

- To introduce Social Security Schemes (SSS) to the rural population.

- To encourage opening of bank accounts.

- To increase household savings levels.

- To encourage savings like RD, STDR for under-privileged groups.

- To protect against unfair and discriminatory practices, such as predatory lending.

- To reduce cost of money transfers.

- To increase financial education.

- To introduce Savings Program by Women

- To remove geographical/physical barriers.

- To reduce infrastructure and connectivity barriers.

- To lower levels of financial literacy.

- To reduce social and technological inclusion.

- To remove cultural and psychological barriers.

- To remove linguistic and educational barriers.

- To remove additional barriers for migrant workers.

TECHNOLOGY/ PROPOSED SOLUTION :

Information and Communications Technology with a focus on Mobile Banking is the key area of Technology. Financial inclusion, Electronic Payments, Branchless banking, MICRO ATMs are proposed solutions towards successful business.

The RBI has also encouraged the setting up of National Payments Corporation of India (NPCI) to act as an umbrella organisation for operating Retail Payment Systems (RPS) in India.

Core Banking Solution (CBS) is a step already taken towards enhancing customer convenience through “Any-where, Anytime Banking”. It is important to leverage on to this technological advancement to look at areas beyond CBS that can help not just in delivering quality and efficient services to customers but also generating and managing information effectively.

Installation of Automated Teller Machines (ATMs), White Label ATMs (WLA), Point of Sale (POS) Terminals and Micro ATMs act as Business Correspondents to banks.

OUR TEAM

L.AROKIASAMY - (L.A.SAMY)

is a sociologist involved in teaching and conducting workshops and seminars in many universities. He studied in St. Joseph’s College, Bangalore, and did his PGDS at St. Francis Xavier University, Nova Scotia, Canada.

He is the vice president and continual coordinator on Human Economy in Asia.

He mentored on Social Protection of Informal Workers in India, paved the way forward for MNREGA programme , Panchayat Raj and the status of primary education in Tamil Nadu. He co-authored the latest book on Paths of Human Economy, the preface of which was written by late United Nations Secretary General, Kofi Annan.

With a special focus on women employment, entrepreneur development and job creation for rural population, he constructed over 10,000 houses and installed 285 drinking water wells to solve the drinking water problem in 300 villages of Karur district. He also provides training to women self-help groups and creates income generation programmes for sustainable development. He conducts exposure training for national and international universities on practical alternatives.

SARAVANAN RAMASAMY - DIRECTOR

STUDIED BACHELOR OF MECHANICAL ENGINEERING

Entrepreneur with hands-on experience in the entire gamut of IT related functions, backed by capacity for client interaction and team management.

Worked as a Senior Business Analyst, for a financial service organization in Melbourne, Director in M/s. Sri Saravanan & Co., – Logistic firm and as a Trustee in an Non-Profit Organization (Action for Rehabilitation, Reconstruction Education Development Support Trust) along with LA Samy.

As a Director in M/s. HASU Infotech (India) Pvt Ltd., he trained around 7500 employees in various organizations through outdoor adventure programs at Yelagiri Hills, Tamil Nadu, increasing team bonding and leadership qualities among the participants

DR. SUNDARA BABU NAGAPPAN,

ADVISORY BOARD

is a public policy analyst, a social-action researcher and a grassroots civil society educator. Since 1998, he has been involved in several ongoing studies and trainings with particular focus on humane economy, community health, social solidarity, equitable land-water relations, organic farming, and conflict transformation. He holds MA-MPhil-PhD degrees from the Jawaharlal Nehru University, New Delhi

DEVASAGAYAM

ADVISORY BOARD MEMBER

Studied social work and have been in the development sector for more than three and a half decades. Have worked with almost all the marginalised communities and contributed to the empowerment of women, children, tribals, the disabled, farmers, rural artisans, Dalits, informal workers and migrants in the southern states of India.

Participation in the development sector with grass-root NGOs, people’s movements, support service organizations, INGOs and as a government consultant allowed me to gain professional experience in community organization, project management, resource mobilisation strategies, evolving monitoring mechanisms, action research, training, coordination, networking, advocacy, lobbying, documentation and skills in liaising with various stakeholders.

Contributed to various projects through vision building, strategic planning, developing systems for monitoring and evaluation, team building and conflict resolution. Worked with the grass roots and trade unions includes the formation of social movements and strengthening leadership capacities, strategizing interventions, developing monitoring and periodic reflective systems for the performance of the management team and administrative bodies.

Have done a number of studies and research on social themes and NGO project evaluation processes. In the last 10 years, I have also been involved in CSR policies, project designs and training the CSR implementation teams.

UMA MAGESHWARI DIRECTOR

Worked as Business Analyst in Reuters, Bangalore and also practices as a Counseling Psychologist

KALAIMANI R

CHIEF FINANCIAL OFFICER

More than 15 years of accounting experience , heads the accounts’ team for various projects.

MOHANA SUNDARAM S GENERAL MANAGER

More than 15 years of experience in the Insurance sector and Banking. Worked in a leading business correspondent company, Mumbai. Has handled more than a few thousand outlets across India. Has a varied network of professional contacts in government organisations.

SRIDHAR G GENERAL MANAGER - ADMIN AND TRANSPORT

More than 32 years of experience in logistics and administrative works, manages Admin & Transport departments efficiently.

PRASANNA G

CHIEF TECHNICAL OFFICER

He has more than 15 years of IT experience, and is responsible for handling the IT related infrastructure for the company, liasing with various banks, payment banks & client servers.

ANAND S

ZONAL HEAD

After his degree in commerce, he joined the banking sector as a customer service executive and rose to the position of State Head, handling around 700 outlets in Telecommunication and Banking. He has traveled across the State and has good liaising skills with Banks & Clients.

SRINIVASAN M

HEAD TRAINER

Deals with training of new employees and vendors,. giving them hands on experience in real-time projects.

MURALI V

HEAD IT

Has excellent IT skills with a focus on ATMs, Laptops, biometrics and all banking sector services.

MARKET PAINS

1. To cater banking services in un banked villages and rural centers of India

Need to Improve Financial Literacy / Lack of Formal Identification Documents (KYC) / Consumer Protection / Overcome the Rural Poor and Gender Inequality

2. Additionally, to cater banking services and financial access to the North east of India

Northern part of India falls in the bottom pyramid of Financial inclusion / Difficult terrain / lower population densities / Poor infrastructure / Inadequate communication facilities / law and order disruptions

3. To cater the financial needs of the poor people

Difficulitites in providing basic financial services without looking at a person’s income or savings / providing reliable financial solutions to the economically underprivileged sections of the society without having any unfair treatment / being transparent while offering financial assistance without any hidden transactions or costs

4. Many poor households in India that do not have any access to financial services in the country.

They are not aware of banks and their functions. Even if they are aware of banks, many of the poor people do not have the access to get services from banks

5. KYC Issues

Economically underprivileged people of the society donot have proper documents to provide to the banks for verification of identity or income. Every bank has certain mandatory documents that need to be furnished during a loan application process or during a bank account creation process. Many of these people do not have knowledge about the importance of these documents. They also do not have access to apply for government-sanctioned documents

6. Expanding and Deepening of Digital Payments Ecosystem to rural india:-

Difficulties in bringing in mobile banking or financial services in order to reach the poorest people living in extremely remote areas of the country also providing tailor-made and custom-made financial solutions to poor people as per their individual financial conditions, household needs, preferences, and income levels

7. Educating and Reaching the Social Security Schemes (SSS) to the rural people is a difficult process and Low levels of financial literacy

8. Savings Program by Women

Empowering women belonging to low-income groups by increasing financial awareness / only men had their own mobile phones and women had to depend on these men

9. Cultural and psychological barriers

10. Linguistic or educational barriers

11. Remove additional barriers for migrant workers

Apart from the Untouched areas, Unbanked sectors in India, We also focus on the following,

- Direct Sales to Individuals

- Partnering with PSU Banks

- Partnering with Payment Banks

- Partnering with Private Banks

CURRENT DEVELOPMENT STATUS

SCALABILITY

- Targets groups that are largely excluded

- Targets low-income groups, including rural, isolated or disadvantaged populations, micro-entrepreneurs, the young and women. Also seek to reach the elderly, indigenous populations, ethnic minorities, migrants and parents.

- Targets entrepreneurs for supply-side initiatives designed to improve financial inclusion: most notably in relation to microcredit.

- Identifying and training trusted partners – Joining hands with NGO / Rural initiative / Co-operative societies / Trusts / Rural Banks / Social Entrepreneurs / Corporate Business Correspondents (both National & Regional) / Telecom distributors and other existing network groups.

SHGS

FARMER PRODUCER COMPANIES

OUR TIMELINE

FY 22 - 23 to scale to 10,000 outlets – Employments / Customer Service Executives

To open up 500 – 1,000 Outlets in each state, therefore covering up at least 10 states in the first financial year.

Revenue sharing in a minimum of 10,000 outlets. 10,000 families will be directly benefited through monthly commissions while servicing more than 20,000 villages in India. Each Customer Service Executive will cover a minimum of two SSA or non SSA villages

FY 22– 23 to reach 2000 SHGs

Each Customer Service Executives will reach out to a minimum of 10 Women Self Help Groups in the first year. Leading and monitoring of the groups will start after three to five months

FY 22– 23 to reach 2000 FPC

Each Customer Service Executives will reach out to a minimum of 5 Farmer Producer Company with the help of locals or NABARD in the first year. Understanding the needs help them with the demand and supply. Continuous supply of materials and finances to the groups.